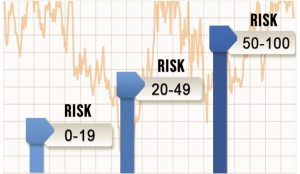

Find Your Personal Risk Score

Most people have no idea what their true appetite for “risk” is when it comes to growing wealth for retirement. We use the industry’s most accurate risk assessment software to help clients determine their personal Risk Score. If you want to know your Risk Score on a scale from 1-100, click on the button below.

Most people have no idea what their true appetite for “risk” is when it comes to growing wealth for retirement. We use the industry’s most accurate risk assessment software to help clients determine their personal Risk Score. If you want to know your Risk Score on a scale from 1-100, click on the button below.

Do you wonder how risky your investments are?

Find out by using our Investment Risk Quick Score App!

Finally a Solution to Student Debt

When you use every available dollar to pay down your debt ALL THE TIME, your daily interest charges are reduced and doing so over the life of a loan has a tremendous compounding effect.

Why Choose Us?

Our firm is unique because we always put our client’s needs first. That may seem like an obvious statement, but as we’ve found out when reviewing several new client’s previous advice, many times the advice advisors give is what’s best for them and not their clients.

Our firm prides itself in its knowledge on a broad spectrum of concepts and products. Even so, we know it is impossible for one person or one firm to know it all. That is why we have strategic alliances with some of the top law firms in the country as well as other top experts in the finance and insurance fields.

Our goal is to be “the” place a client can turn to get answers/help on asset protection, income, estate, and capital gains tax reduction, growing wealth in the least risky manner possible, estate planning, business/corporate planning issues and much more.

We hope you enjoy our website and find time to both read various parts of the site as well as watch several of the educational presentations.

More Information

While that’s important, such gurus forget that the #1 creditor clients have every year is the IRS (taxes). Also, people are much more likely to lose money in the stock market in any given year than to be sued for negligence. The goal of a “good” asset protection plan is to make sure “all” of your assets are protected from “all” creditors. This is the specialty of our firm as you will learn when you review our site.

How much risk should you take to reach your financial goals? Our answer is that clients should take the least amount of risk necessary to reach their financial goals (unfortunately most Americans do not take this approach and pay the consequences when the stock market tanks).

This web-site discusses many unique wealth-building tools so readers can educate themselves and make “informed” decisions about the “best” way to grow their wealth.

Bad Advisors: How to Identify Them; How to Avoid Them

The Doctor’s Wealth Preservation Guide

Growing Your Retirement

Growing Your Retirement – Keep your money safe while growing your principal.