Closely-Held Insurance Company (CIC)

Closely-Held Insurance Company (CIC)

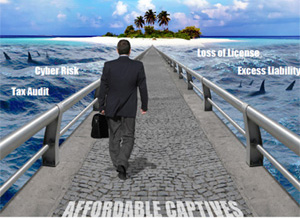

— Is Becoming Your Own Insurance Company Right For You? —

You May Be Surprised!

How Many Other Ways Do You Have to Tax-Deduct Up to $1.2 MILLION Dollars Pre-Tax into a Tax-Favorable Entity You own?

Can owning your own Closely-held Insurance Company (”CIC” — also known as Captive Insurance Company) can provide both surprising and satisfying results.

If you prefer to watch a Video presentation explaining the value of CICs, please enjoy the video below.

Fortune 500 companies have long used CICs to manage risks and gain tax advantages. However, it is only in the last decade that medium to small businesses have begun to take advantage of them as well. If the CIC is established and maintained properly, and if it’s suited to the economic needs of the business and its owners, it can be an ideal tool.

How does a CIC work?

CICs are amazingly simple. An individual, company, or trust sets up and finds the needed money to form and capitalize a real live insurance company. Once setup, the CIC functions just as most insurance companies you are probably familiar with. The CIC sells insurance coverage to various businesses (the majority of which are your businesses), takes the premium dollars and invests them to pay claims, and, when needed, goes to the reinsurance market to purchase reinsurance to cover catastrophic losses.

If the insurance claims of the CIC are low, the CIC will, over time, accumulate significant money. Profits of the CIC are taxed at the C-Corporation rate (although such taxes can be minimized with proper planning) and then when the time is right, a CIC can be shut down at which time all the accumulated wealth of the CIC is taxed at the long-term capital gains tax rate (not ordinary income tax rate).

Where are CICs typically formed?

The insurance company can be setup domestically in over 25 states or internationally in several jurisdictions.

Why would you possibly even consider forming your own CIC?

Three main reasons:

- Provide your business insurance coverage (which can reduce costs significantly for some).

- Income tax reduction and wealth building (your business can take a simple 162 business deduction for needed insurance that is paid to a CIC you own).

- Estate tax planning (if you have an estate tax problem, you may choose to have your CIC owned by an irrevocable trust. Doing so will shift a tax-deductible dollar out of your estate over night when premiums are paid. With a good claims history, the premium dollars will flow to your heirs income, gift, and estate tax free.

A Word Of Caution

To create a CIC structure properly, you must use professionals who have expertise in this area. There has been significant abuse with CICs over the years and if you work with the wrong CIC providers, the tax and penalty consequence can be significant. You do NOT want to go with a firm you found on the internet or heard about at a fly-by-night seminar. This is one area where “doing it right” is the only way to enjoy the CIC’s benefits while staying out of trouble with the IRS.

Does this sound like something that might want to learn more about? If so, contact our office at info@thewpi.org and setup a time when we can discuss whether a CIC may be a viable tool for you and your business.